Professional women are expected to do everything and be everything.

Professional women are expected to do everything and be everything.

I juggled two children. One with special needs.

I had to be the perfect mother.

I had to be the perfect caretaker and meet all the requirements of being a wife.

I struggled to write the perfect reports for work.

Does this sound like how you feel? Is this what you see every day of your current reality?

Perfection in your career.

Perfection in your home.

Perfection is a burden.

When the rate of inflation and the cost of interest rise, it makes our relationship with our income less than perfect.

Income is a critical aspect of our financial life.

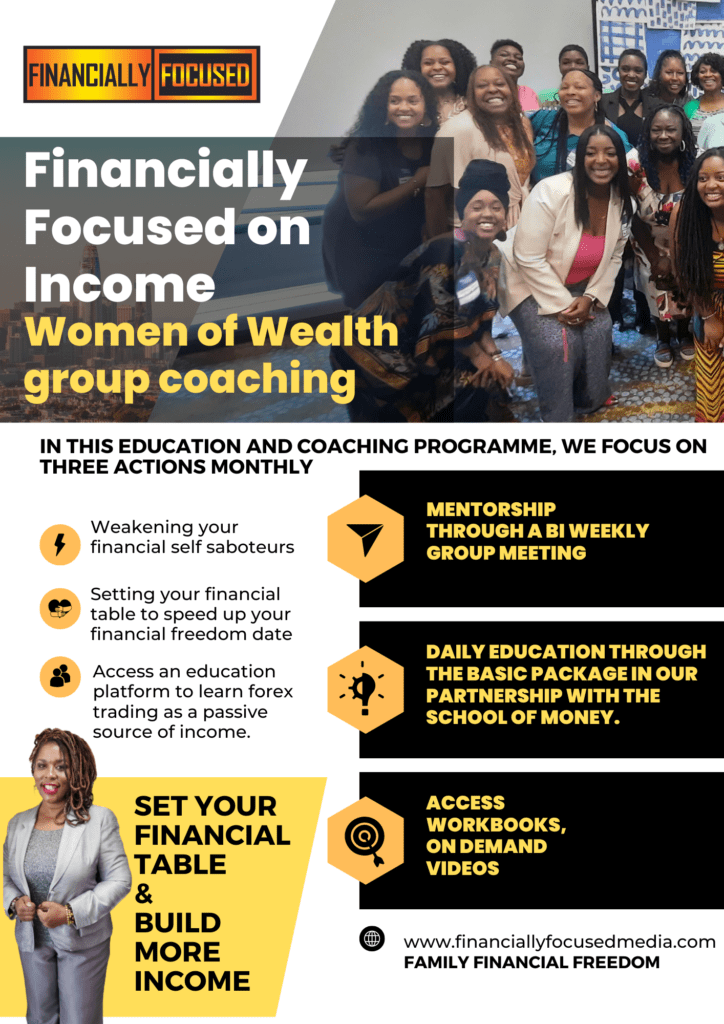

So to assist you in charting your way forward, we present the following checklist. Now, in our Women of Wealth coaching programme, we work with your mental fitness and financial fitness to overcome the self sabotage behaviour that we have carried forward over the years. If any of the items on the checklist speaks to you, be sure to book a complimentary appointment with me today!!

If you’re a professional woman looking for ways to earn cash flow, investing in dividend income can be a great option. Here’s a 50 point checklist to get you started:

- Determine your investment goals.

- Research different stocks and companies.

- Look for companies with a long history of paying dividends.

- Consider companies with a strong financial position.

- Check the company’s dividend yield.

- Consider the company’s payout ratio.

- Look at the company’s dividend growth rate.

- Consider the company’s industry and growth potential.

- Determine how much money you can afford to invest.

- Consider opening a brokerage account.

- Determine your investment time horizon.

- Decide on a dividend reinvestment plan (DRIP) or receiving cash payouts.

- Review the tax implications of dividend income.

- Consider diversifying your investments.

- Determine your risk tolerance.

- Monitor your investments regularly.

- Keep up with industry news and company updates.

- Consider dollar-cost averaging.

- Review your portfolio periodically.

- Determine when to sell a stock.

- Set realistic expectations for your returns.

- Invest in companies with a track record of increasing dividends.

- Consider investing in index funds or exchange-traded funds (ETFs) that focus on dividends.

- Monitor dividend dates and ex-dividend dates.

- Consider investing in preferred stocks.

- Review the company’s financial statements.

- Look for companies with a low debt-to-equity ratio.

- Consider companies with a competitive advantage.

- Look at the company’s return on equity (ROE).

- Look at the company’s earnings per share (EPS).

- Consider companies with a history of share buybacks.

- Consider investing in real estate investment trusts (REITs).

- Look for companies with a diversified customer base.

- Consider the company’s management team and their track record.

- Look for companies with a history of stable earnings.

- Consider investing in blue-chip stocks.

- Look for companies with a low price-to-earnings (P/E) ratio.

- Consider companies with a high dividend coverage ratio.

- Look for companies with a history of positive cash flow.

- Consider investing in mutual funds that focus on dividends.

- Look for companies with a high return on assets (ROA).

- Consider investing in international stocks with a history of paying dividends.

- Look for companies with a high dividend payout ratio.

- Consider investing in utility stocks.

- Look for companies with a history of dividend increases during economic downturns.

- Consider investing in consumer staples stocks.

- Look for companies with a history of consistent earnings growth.

- Consider investing in energy stocks.

- Look for companies with a high dividend yield relative to their industry.

- Consider investing in healthcare stocks.

By following this 50 point checklist, you can start earning cash flow from dividend income and build a solid investment portfolio to help secure your financial future.