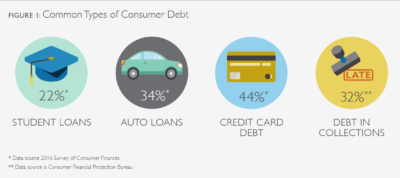

When it comes to clearing off bad debt, do not wait for the bailiff to come. The critical thing is to do something. It may seem like your debt problem is the heaviest in the world, however, no debt situation is permanent. You may wonder what is it that the team at DEBT HEALING BY FINANCIALLY FOCUSED actually do? What we do is take a stand for our clients. If you are in a rough situation with your debt, we first assess the type of debt you have.  Are you dealing with a debt emergency? If that is the case, these debts must be negotiated QUICKLY because you could be in legal trouble or be without a roof over your head. How do you know you are in a debt emergency? Usually, it is a court matter and you need strong support. Next, we deal with Priority Debts. These are high in priority because they will impact your standard of living if they are not paid off. At this point in the DEBT HEALING process, DEBT COUNSELING is critical along with the action. Here we want to deal with BEHAVIOUR CHANGE and not just handling paperwork or bank negotiation. Then there are Non Priority debts. Usually, these are expensive debts like credit cards, personal loans, overdrafts, and other loans. These are the debts we help our clients clear. |

| Debt Relief Options – Types of bills you can repay. Unsecured bills such as: Debts incurred through medical treatment Bills acquired through cash advance loans Debts assigned to collection agencies Bills accumulated through credit card purchases Debts accrued through utility services Next, we look at debt payment strategies. |

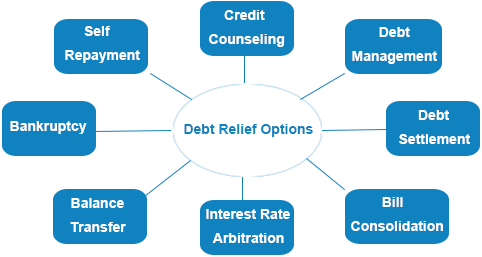

| When you are ready to clear your personal debt, there are many options. Credit Counseling In a credit counseling session, the counselor analyzes your financial condition and offers suitable tips or suggestions following which you can repay your existing dues. What to expect: Pros Customized money management plan to manage your debts properly You can pay back creditors through easy repayment plans You can figure out whether or not you’re spending more Cons May worsen your financial situation if you cannot avoid impulsive spending When to opt for: To manage your existing debts smartly You need help to plan a realistic budget Want to manage debts properly to improve your credit score Debt Management In a debt management program, the counselors of the debt relief companies negotiate with your creditors for a repayment plan as per your budget. You need to make a single monthly payment to the counselors, who distribute the amount amongst your creditors. This continues till you get out of debt. What to expect: Pros The reduced interest rate on debts A budget plan to save money Single monthly payment Possibility of less collection calls Positive effect on credit report and score Cons Have to pay fees for professional service When to opt for: You’re facing problems to manage your multiple bills You need professional guidance You have a decent income to repay your debt You want to repay debts in full Debt Settlement A debt settlement program is a debt relief program that helps to reduce the outstanding balance on your bills/debts. The representative from the settlement company negotiates with your creditors and/or collection agencies to reduce the payoff amount so that you can get rid of debts through a lump sum payment on each account. What to expect: Pros You can get rid of debt quickly Possibility of creditors/collection agencies will stop harassing you Become debt-free through single monthly payments Cons Need to pay professional fees Credit score may get reduced May have to pay tax on forgiven debt When to opt for You cannot repay your debts in full You want to get rid of your debts fast You can’t negotiate with your creditors on your own Your financial situation doesn’t permit to repay debts in full Bill Consolidation When you enroll in a bill/debt consolidation program with a debt relief company, it analyzes your financial situation and decides upon an affordable monthly payment that you need to pay to the company. It also negotiates with your creditors to reduce the interest rates on your debts. Upon receiving payment, the consolidation company distributes it amongst your creditors as per the agreement, till your dues are paid off. What to expect: Pros Single payment every month Interest rates may get reduced Complete professional guidance to pay back dues Credit score may get improved Creditors may stop troubling you for payments Cons Need to pay professional fees When to opt for Failed to repay outstanding dues on your own You can save a certain amount after meeting daily necessities You’re not able to manage your multiple bills properly Professional guidance can help you manage your financial obligations Interest Rate Arbitration You take out a secured loan from a lender or a financial institution at a relatively low-interest rate and repay your outstanding dues with the amount. Then, you repay the new loan, which is a type of debt consolidation loan, through lower monthly payments. What to expect: Pros You can repay your total outstanding balance at once You replace your high-interest debts with a comparatively low-interest loan You have to make only a single monthly payment Cons May lose collateral if you cannot repay the loan on time When to opt for You have collateral to pledge in order to obtain a loan You are confident to make the monthly payments to repay the new loan on time Want to lower your interest rates Want to repay bills through the low monthly payment Balance Transfer When you opt for a balance transfer method, with your creditors’ approval, you actually transfer your high-interest bills to a relatively low-interest card with a sufficient credit limit. Thus, you repay your outstanding dues at a reduced rate of interest. What to expect: Pros Replace multiple credit cards with a single one Pay off outstanding credit card dues at a relatively low-interest rate Can save the money which you’d have to pay if you opt for professional help Cons May fall into debt again if you start using high-interest credit cards and not repay dues in every billing cycle When to opt for You’re struggling to manage your high-interest credit card bills Facing difficulty in remembering due dates of multiple credit cards You want to repay debt without any professional help Bankruptcy In this debt relief option, you repay your debts through a court-monitored repayment plan. You can pay back your creditors through either Chapter 7 or Chapter 13 bankruptcy, depending upon which one you qualify for. What to expect: Pros Creditors and collection agencies will not contact you for payments In Chapter 7 bankruptcy, you can become debt free within 3-4 months It will put stay on impending lawsuits Your creditors will not be able to garnish your wage Cons Your credit score will get reduced by about 200 points depending upon your present score When to opt for You want to make a fresh financial start This is your last option to get rid of your financial obligations Self Repayment Plan This is where you repay your debts on your own following the basic financial principles such as budgeting, saving along reducing irrelevant expenditures. What to expect: Pros Don’t have to pay professional fees Can avoid being scammed by imposters posing as professionals Positive impact on credit report after paying off debt Cons Cannot be successful if cannot plan a budget or if you spend extravagantly |