Greetings and blessings. I am so glad you are joining me on this journey to create your personal INCREASE your SAVINGS/REDUCE your DEBT plan of action. It might sound like an impossible task. I hope at the end of this challenge you will have received the support you need to think differently. You can see the entire challenge here.

Over the next 21 days we are looking at how to increase your savings and reduce your debt using over 20 strategies that touch on:

- Income

- Investments

- Debt strategies

- Mindset

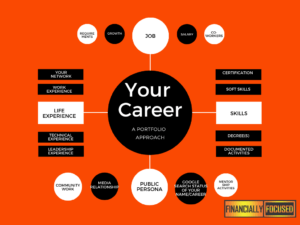

- Your Career

So let’s get started.

A few days ago, I was sitting in Starbucks listening to Stevie Wonder’s Inner Vision album and thinking how 10 years ago, I was on my face. My children were babies and one day in 2011, I was so stressed that my knees gave out.

I felt like to big up myself for having the sense to fall gracefully in front of my car rather than fighting the feeling and having a bad injury. Everything was wrong! I wasn’t creating artwork, I was in a job so emotionally draining and toxic I could barely breathe. My days were filled with work and hospital visits for my child’s heart and lung condition. It was torture.

Nothing I did worked.

UNTIL.

When I was at rock bottom, I did what Les Brown suggested. I looked up and decided to go for the stars. I also remembered my Sunday School days when we sang about Counting Our Blessings One by One. So that is what we are doing first. Counting our blessings. Your assets, including your CAREER (not your job), are a blessing and can be maximized to the fullest.

Your debts are (believe it or not) also blessings.

Why? Because someone or some company trusted you to give you access to what you wanted before you could pay for it. So that means you are a person of worth and that worth must be accounted for. Your credit score, regardless of what it is, is a testament to the fact that you are here and you are a person of worth!!! So let us get down to business. What are your assets right now? What are your liabilities right now?

Subtract the assets from the liabilities/debt and get your NET WORTH. Check out this free worksheet to help you to keep track of where you are right now in terms of your net worth. So what does that mean? Well, it is just a snapshot of where you are right now. It is not about feeling bad that is you not where you want to be. That is what this challenge is about. We are going to take the next 20 days to reduce your debt and increase your income.

Ready to do the work?

Financially Focused is a safe space where you can learn to build a custom money map for your desired lifestyle. You already know how to make money. I am going to show you how to MULTIPLY your money. So how can I help you directly? I am going to hold your hand (virtually, of course, 😊) as we take on the task of reducing your debt and increasing your savings.