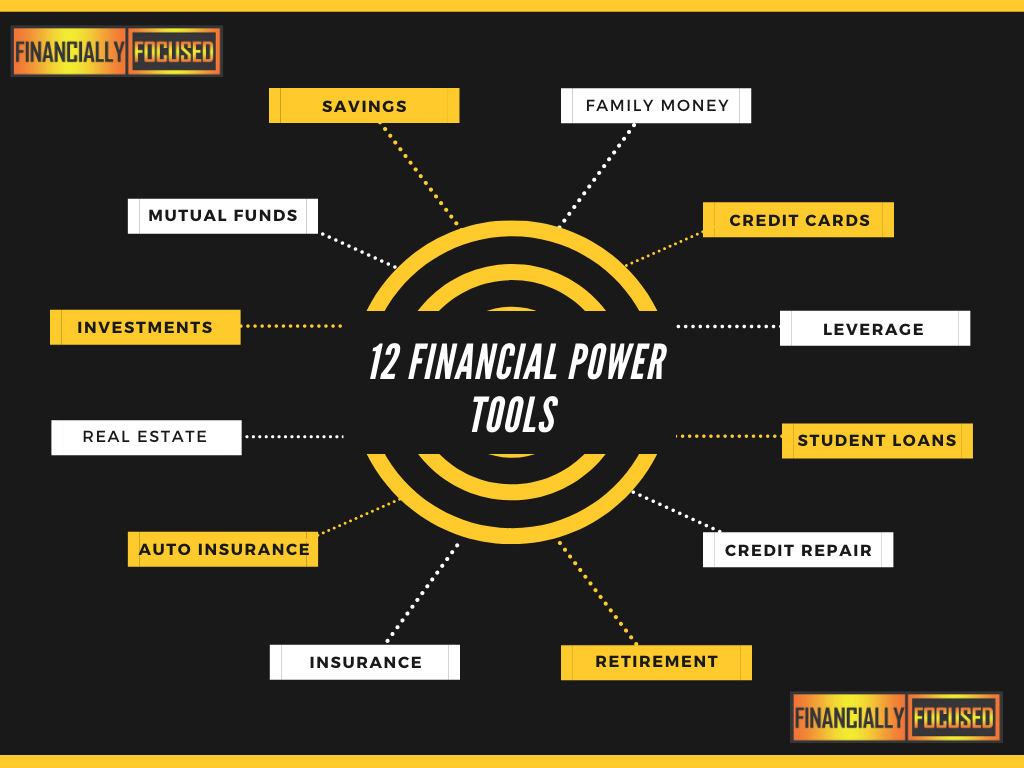

Want something spicy for the holidays? Is your gift-giving habit the same as your money habits? Love and money are two topics that always prick strong emotion. Check out our free 21-day challenge to super charge your investment returns at www.financiallyfocusedmedia.com. Now this awesome article from the Wall Street Journal talking about love and money has got my attention! And why I love being a financial coach to help people sort out their issues and get control of 12 financial areas that cause so much stress. When trying to understand this complicated interplay, a good place to start is to look at your relationship with money through the lens of attachment theory, which holds we all have an interpersonal attachment style that is on a continuum from secure to insecure. Most of humanity tilts somewhat toward the insecure side and exhibits behaviors ranging from anxious (think of a Labrador retriever that can’t get enough of you) to avoidant (think of a cat that behaves as if it can do very well without you).

“If you are needy of love, the more anxious type, you use money as a means to be loved and be appreciated and have people around you,” says Mario Mikulincer, a professor of psychology who studies human attachment at the Interdisciplinary Center, a research college in Herzliya, Israel.

You may fall in the anxious category if you often pick up the check, give expensive gifts, regularly buy new cars and wear pricey clothes. Maybe you’re the person others treat as an ATM, bumming a few dollars or asking for larger sums because you have a hard time saying no. You may also be a “herd” or impulsive type of investor, putting money in and pulling it out of investments according to swings in the market.

The more avoidant types, on the other hand, are more staid, saving money so they won’t have to rely on others or can exert power over them. This might be you if your generosity has strings attached—like maybe offering to pay for a vacation with friends or family, but you get to decide where and when you go and what you do while on the trip.

“People with avoidant attachments may develop resentment or contempt for those who take their money,” says Dr. Mikulincer, which only reinforces their emotional distance. When it comes to investments, they tend to keep their own counsel, not entirely trusting financial advisers, much less prevailing market sentiment.

Of course, not everyone fits neatly into these categories. Many people exhibit characteristics of both. Your attachment style and how you are with money are uniquely determined by your upbringing, experiences and cultural influences. Depending on your background, you may come to associate intimacy—and money by proxy—with safety, peril, protection, secrecy, control, prestige, power, weakness, virtue, vice, acceptance or rejection. These often dysfunctional associations are typically established early in life and are hard to shake, likely because you don’t even know you have them.

Maybe you were raised by a single mother who sacrificed to pay for the things you needed, which you internalized. As an adult, you may have a hard time spending money on yourself. Your misplaced guilt may lead you to hide receipts from your spouse and even lie to friends that the clothes or shoes you’re wearing aren’t new.

But to really understand the interpersonal attachments and experiences that shaped your beliefs and the continuing impact, psychotherapists and financial coaches encourage people to ask themselves more expansive questions:

• “What did your parents directly and indirectly teach you about money?”

• “What were your most joyful and most painful experiences with money?”

• “Tell me about the last time you and your romantic partner talked about money.”

Want more support in understanding your money style? Check out www.financiallyfocusedcoaching.com