2020 was EASILY the strangest year in most of our lifetimes…so what’s the financial plan for 2021 (this is a long post so buckle up….). First I want to say thanks to Garrett Gunderson for the inspiration for this post. And now let’s get to the meat of the matter.

No matter what the economy, politics, or anything else this crazy world throws at us, there are assets that belong to us and we control them.:

#1 — Make Time

Everyone gets the same amount of time each day … each week … each month.

Those who are successful simply use those hours more wisely. No matter how busy you are you can find time to invest in things that are important to you.

Most people have way more time available than they think. It’s a matter of being intentional with how you use it.

So if you want to simplify your financial life, make wiser investment decisions, and watch your wealth grow every day…

You need to make time to grow your financial intelligence.

You can do it with free resources — like the 21 day challenge to supercharge your investment returns or our Financially Focused You Tube channel . You are most welcome to our private Facebook Group #FinanciallyFocusedOnWealth.

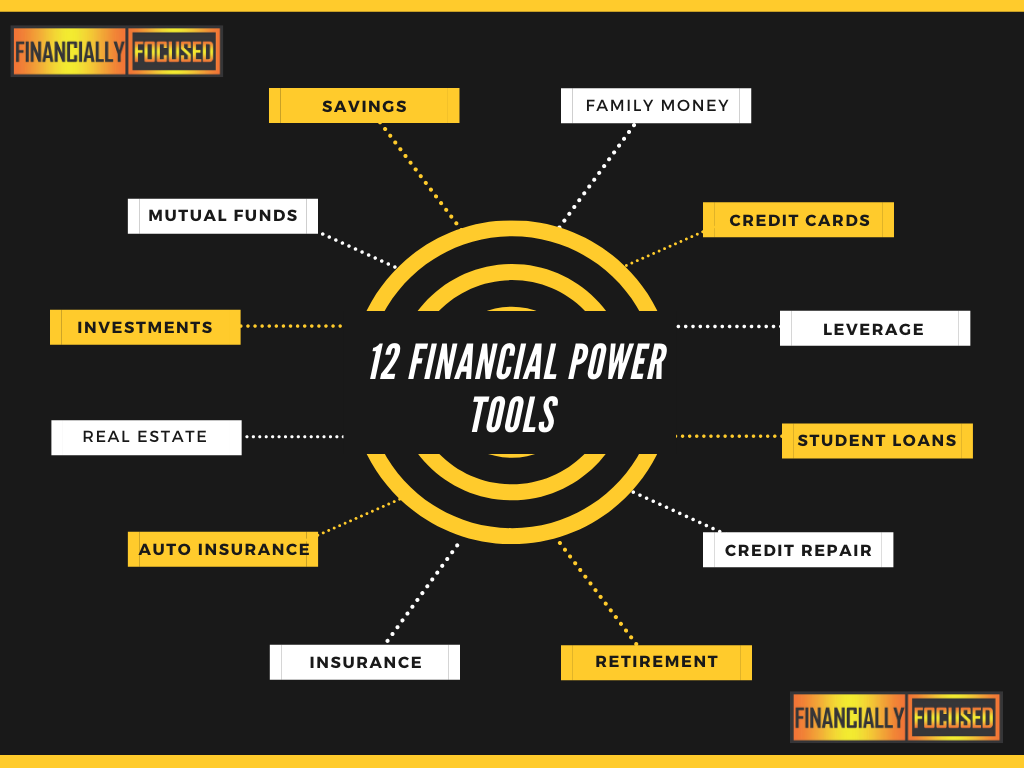

Or you can take FULL advantage of the best-of-our-best financial education in our Financial Mentor Focus Bonus Package that includes up to $23,907 worth of our top courses and programs. Join our waiting list here for notification when the program opens. Financially Focused Mentor not only allows you to build 12 Financial Power Tools, but you also get direct, monthly access to Dennise through regular online mastermind sessions where you get to get to understand the secrets and systems of powerful financial mentors and ask her questions so you can discover your own financial breakthroughs.

It only takes about 1-4 hours of your time each month — because it’s not about the amount of time you spend on expanding your financial intelligence— it’s the quality of the time spent.

And time spent with Dennise is high-quality that will zoom you past all the financial roadblocks holding you back.

#2 — Get rid of this “financial disease” to gain financial muscle

Most people were not raised to know how to handle money well.

In fact, most of us were programmed (unconsciously) to have all kinds of limiting beliefs about money and the role it plays in our lives.

This creates a financial disease that distorts our vision of ourselves and our future. This “disease” is called scarcity.

And most people living in our world have been battling against an unseen financial pandemic of scarcity their entire lives.

Scarcity acts like a disease because it causes us to lose sight of what’s really important.

It forces us to look at the future through a lens of fear, and defer living the life we love until sometime “later” (which never seems to come, because there’s always a new crisis or fear to worry about).

You can learn how to overcome scarcity by viewing interviews on the #FinanciallyFocused playlist on the Youtube channel.

But the absolute BEST way to actually battle scarcity in your life is to surround yourself with people who uplift you, support you, and give you the tools to be abundant and productive instead of living in fear and worry.

A Financial Mentor Focus program gives you everything you need to master this life-skill, automatically. You can join the waitlist here and be one of the first to know when the program opens for 2021. I know about scarcity because I was raised by a family from the inner city and my family had practiced typical lower-class “scarcity” for generations. It took me years to figure out how to overcome these limiting beliefs about money and happiness.

So in the Financial Mentor Focus mastermind sessions, we share the tools, rituals, and frameworks we used to break free. Just hanging out with upwardly mobile persons in the Financial Mentor Focus program once a month is enough to have this abundant, productivity “magic” rub off on you too.

And of course, that’s only one tiny aspect of the value you’ll get from 12 weeks of Financial Mentor Focus masterminds.

#3 — Surround yourself with a team

This is probably the most important — yet most neglected — part of building wealth. Having a great financial team and solid relationships reduces stress, grows your wealth faster than you thought possible, and lets you enjoy Economic and Financial Independence sooner rather than later.

Many people see the success of Dennise Williams — the CEO and founder here at Financially Focused — and think that she’s always been financially set. But I came from humble beginnings. As mentioned, I grew up with the inner city mentality of the scarcity of a family who worked very hard but rarely reaped the rewards.

When I decided to change all that by becoming a financial journalist and investor, I thought he could study my way into success by being smarter than everyone else.

That’s how I became such a knowledgeable expert in so many areas of business and finance. But early in my career, a trusted financial mentor gave me this sage advice: “Growing wealth and investing are TEAM SPORTS.” When it comes to money, many people are lone wolves. They could be enjoying the advantages of a pack, but instead, they choose to go it alone. The result is that they often struggle with their cash flow, pay far too much in tax, and are always wondering why they never seem to enjoy the success of their hard work. Your goal should be to surround yourself with mentors, advocates, and experts who can support you in achieving your financial goals.

If you are a professional or own a business and make over $50k per year, one of our 1-on-1 coaching programs may be a great option for you.

Otherwise, a Financial Mentor Focus program is the perfect way to become part of my inner circle — so you can learn not only from me — but also from all the advisors and influencers that I am in contact with on a daily basis.